#Compound Finance

Explore tagged Tumblr posts

Text

why are they in my credit card information

#important to note: they don't show up like this anywhere else#and ive never. filled in their information. that my browser would save it#genuinely no idea how they got in there#next season of w.bg: The Compound finances my bills??#hey i wouldnt argue#w.bg#woe.begone#woe begone#wbg

19 notes

·

View notes

Text

How to Start Investing with Little Money: Easy Steps to Build Wealth for Beginners 💸✨

Hey, lovely readers! It’s Nada Azzouzi here, and today I’m breaking down how you can start investing—even with little money. If you’re new to the world of investing or think you need a large sum of money to begin, don’t worry! I’ll walk you through simple, easy steps you can start implementing today to build your wealth. 💪 Let’s get started! 🌱 Step 1: Start Small with Automation 💰 Tip number…

#compound interest#Consistent Investing#ETFs for Beginners#Financial Freedom#financial independence#Investing Apps#investing for beginners#investing tips#investment strategies#Learning to Invest#Low-Cost Index Funds#Micro-Investing#passive income#Personal Finance Tips#Reinvest Dividends#Robo-Advisors#Start Investing with Little Money#Wealth Building

4 notes

·

View notes

Text

The exact money moves no one’s teaching you.

Money isn't your enemy, you have been taught wrong.

Here’s how money can rewire your life (if you let it):

1/ Money = Freedom, Not Flash

You don’t need a Lambo.

You need options—to walk away from toxic jobs, say no to crap clients, and sleep without panic.

2/ It’s Not ‘Greedy’—It’s Survival

Rich people don’t feel guilty for thriving.

Why should you? Money buys safety, time, and breathing room.

Stop apologizing.

3/ Money Multiplies Your Voice

Broke = whispers. Wealth = a megaphone.

Want to change things?

Fund your cause, not just hashtag it.

4/ The Best Investment? Your Exit Strategy

Save like you’re plotting a jailbreak.

Every dollar is a step closer to walking out on bullshit.

5/ Money Reveals Who You Really Are

Scarcity turns you desperate.

Abundance lets you choose—better people, better problems, a better life.

6/ Stop Calling It ‘Luck’

You don’t ‘manifest’ cash—you hunt it.

Learn the rules, play smarter, outwork the doubters.

"Money won’t fix you. But it will expose what you’re made of."

What’s your next move to manage your money?

Find this valuable. 'Thank' our editors and get regular content on strategic wealth and money management.

#money#compounding#manifesting#toxic job#financial freedom#financial planning#personal finance#investing

2 notes

·

View notes

Text

9 notes

·

View notes

Text

Mastering Personal Finance and Investing: Your Ultimate Guide to Financial Freedom

Introduction: Understanding the Importance of Personal Finance and Investing Personal Finance and Investing: Your Path to Financial Freedom Importance of Personal Finance and Investing for Wealth Creation The Basics of Personal Finance: Budgeting, Saving, and Debt Management Mastering the Basics: Budgeting, Saving, and Debt Management Budgeting Tips for Effective Personal Finance…

View On WordPress

#personal finance#financial planning#money management#budgeting#savings#debt management#investing#wealth creation#retirement planning#401(k)#IRA#stock market#real estate investing#compound interest#tax planning#financial freedom#financial education#money tips#financial goals#investment strategies#financial literacy#wealth management#financial advice#financial independence#money mindset#financial success

25 notes

·

View notes

Text

The Snowball Effect

10 notes

·

View notes

Text

the thing abt jimmy is he's like a universal slightly disparaged uncle figure. you could be like hey man i hate your guts and he'd be like och that sucks do ye want a nice warm crossaint and some coffee and to talk about it?

he'd offer everyone in the world the option of a nice breakfast if he could but alas he cannot 😔 this is why evil still exists

#flinchite compound member? hes offering you some coffee and the chance to talk about work#member of base? nice to see you again whatre ye doin around these parts? och well good luck ive got some coffee if ye need it#escaped compounder? good luck mate oh by the way the back doors over there if ye need it#id say this man has no enemies but he has so many#he just has a larger supply of crossaints#finance jimmy

9 notes

·

View notes

Text

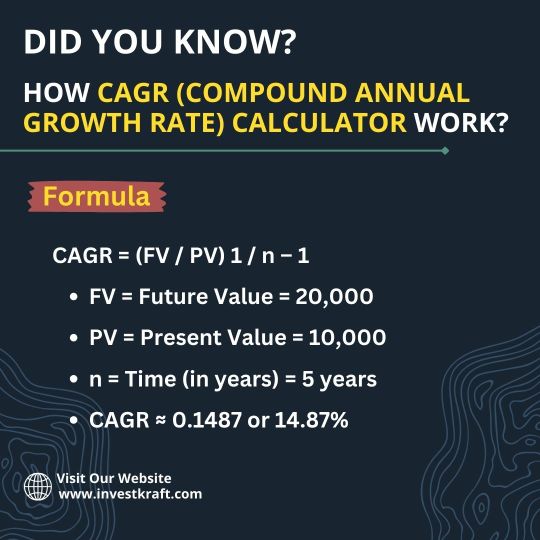

Looking for an Accurate Online CAGR Calculator?

If you're seeking an accurate online CAGR (Compound Annual Growth Rate) calculator, Investkraft website is your solution. With Investkraft, you can effortlessly determine the growth rate of your investments over multiple periods. This user-friendly tool simplifies complex calculations, making it accessible for everyone, from seasoned investors to beginners. Simply input your initial and final investment values, along with the time period, and let Investkraft do the rest. Accuracy is paramount when analyzing investment growth, and Investkraft ensures precise results every time. Whether you're planning your financial future or evaluating past performance, Investkraft's online CAGR calculator provides the reliable insights you need. Take control of your investments today with Investkraft and make informed decisions for a prosperous tomorrow.

#investkraft#finance#financial calculators#Compound Annual Growth Rate#CAGR Calculator#calculators#financial services

2 notes

·

View notes

Text

here's a tech tidbit for the day. in large part, the US's current lack of green energy isn't because the tech doesn't exist or that the tech isn't cheap/competitive with fossil fuels - it's because of bureaucratic tangles and permitting delays. Right now it can take new power projects five full years just to get approved to connect to the power grid. (On average, it's taking 3.7 years).

As of the end of 2021, there was over a terawatt of green energy storage waiting to get approval to connect to the grid. That's more than all the energy currently generated in the US. For the most part, these aren't completed projects waiting to connect - they're projects that are ready to build waiting for approval before they break ground, or are partially built and getting their application in so that they're not waiting between construction and transmission. Many requests in the queue will never get built (some because they can't afford to wait in line for five years, or lose land rights, or have their interconnect denied, or require costly restudies after design changes, or for unrelated reasons) but even if the historical rate of 25% of them were to succeed, that's still hundreds of gigawatts of power and enough to more-than-replace all the coal plants in the US.

That's not the only obstacle to construction (see also: transmission capacity, load balancing, environmental studies, permitting, and a host of other factors). To be clear: waving a magic wand and lifting this particular barrier wouldn't mean green energy right away forever. But this problem is a decent representative of the type of obstacle green energy faces. Generation and transmission of energy are - largely - cheap and efficient. Getting systems approved and integrated across a morass of local, state, and federal governments, utility companies, and ISOs? Slow and hard.

#green energy#perpetually:#there is a major roadblock#that roadblock consists of a real 'technical' problem (coordination integration and construction of large infrastructure)#and a real 'social' problem (coordinating among gvts. jurisdictions. public and private companies. states. etc for payment & responsibility)#compounded and multiplied by the current structure around that social task (often major improvements rely on some random gvt worker#in a small county in Arizona which does not have enough money to do this work quickly or well#in order to get power to Texas. e.g. And conversely#sometimes it's the structure of a legal requirement for a gvt to pick the cheapest option instead of the best#or the financing incentives that *discourage* utilities from building lr improving transmission lines#or. yknow. american-flavor capitalism aiming for quarterly investor financial reviews yoked to a bureaucracy that moves at 5-year speeds

7 notes

·

View notes

Text

The FIRE Movement: A Comprehensive Guide to Financial Independence and Early Retirement

Introduction In recent years, a revolutionary concept has emerged in the realm of personal finance, captivating the imagination of young adults worldwide. Known as the FIRE movement, which stands for Financial Independence, Retire Early, this philosophy offers more than just financial advice—it proposes a radical shift in lifestyle. This in-depth guide explores the intricacies of the FIRE…

View On WordPress

#asset allocation#budgeting tips#Compound interest#early retirement#financial autonomy#financial freedom#financial independence#Financial planning#FIRE movement#frugality#lifestyle choices#lifestyle inflation#living below means#passive income#personal finance#retire early#retirement planning#Risk management#savings strategies#side hustles#smart investing#Wealth Management

6 notes

·

View notes

Text

Unlock Financial Wisdom with "Rich Dad Poor Dad": A Life-Changing Read

Written by Delvin Hey there, fellow bookworms and aspiring wealth builders! Today, I want to share with you one of my all-time favorite books that had a profound impact on my financial mindset: “Rich Dad Poor Dad” by Robert Kiyosaki. This book holds a special place in my heart as it was not only one of the first books I ever read but also the catalyst that sparked my journey towards financial…

View On WordPress

#Affiliate Marketing#assets vs liabilities#Compound Interest#dailyprompt#Financial#Financial Freedom#Financial Independence Retire Early#Financial Literacy#FIRE#Generational Wealth#knowledge#money#Money Management#Moneymaking#Motivational#Passive Income#Personal Finance#Real Estate#Rich Dad Poor Dad#Wealth

4 notes

·

View notes

Text

Unlock Your Money Mindset: The Psychology of Money Summary You Can Actually Use

Psychology of money summary: Crack the code to lasting wealth with Morgan Housel’s game-changing insights. This isn’t another investment manual—it’s your field guide to fixing the broken money behaviors keeping you broke. Discover why IQ fails where mindset prevails, how to harness compounding’s silent superpower, and why ‘enough’ unlocks more freedom than fortunes. Core Insights: Rewiring Your…

#behavioral finance#compounding wealth#define enough#financial behavior#financial freedom#money psychology#Morgan Housel#psychology of money summary#uJustTry action guide#wealth mindset

0 notes

Text

The Power of Compound Interest Explained Simply

Compound interest is often called the eighth wonder of the world—and for good reason. It's a powerful financial force that can help your money grow exponentially over time. But what exactly is it, and why does it matter? Read More..

0 notes

Text

Building Wealth in Your 20s: Simple Investment Strategies That Work 💰📈

Hey there, I’m Nada Azzouzi, and if you’re in your 20s, wondering how to get started on building wealth, you’re in the right place! The earlier you start investing, the more time your money has to grow. With a few simple strategies, you can set yourself up for financial success and enjoy the benefits of your hard work for years to come. 🌱💸 Let’s dive into how you can begin investing wisely…

#401k matching#beginner investing advice#building wealth in your 20s#compound interest#diversify your portfolio#employer-sponsored retirement accounts#Financial Freedom#financial success in your 20s#financial tips for millennials#fractional shares#how to grow wealth over time#how to invest in stocks#how to start investing in your 20s#investing basics#investing for young adults#investing in index funds#investment strategies for beginners#Low-Cost Index Funds#passive income#Personal Finance Tips#simple investment tips#start investing today#stock market for beginners#wealth-building strategies

0 notes

Text

12 Habits to Help You Reach Financial Freedom in 2025 and Beyond

Dreaming of financial freedom—where money works for you, not the other way around? In the USA, achieving financial independence is within reach if you adopt the right habits early. Whether you’re paying off debt, saving for retirement, or building passive income, these 12 habits to help you reach financial freedom will set you on the path to success. From budgeting to investing, this 2025 guide…

#401k savings#budgeting usa#Compound Interest#financial freedom usa#Financial goals#habits for financial independence#passive income usa#Personal finance tips#roth ira 2025#Wealth building

0 notes

Text

Time in the Market vs Timing the Market – Which Strategy Wins?

Discover why staying invested long-term often outperforms trying to time the market. In this insightful blog, Certified Financial Planner Niraj Nanal breaks down the risks of market timing and the proven benefits of disciplined investing. A must-read for anyone looking to grow wealth smartly and steadily.

URL:-https://nirajnanal.com/blog/time-in-the-market-vs-timing-the-market/

#Time in the market#Timing the market#Long-term investing#Stock market strategy#Investment planning#Market volatility#Wealth building strategies#SIP vs lump sum#Financial planning tips#Investor mindset#Risk vs reward investing#Compounding returns#Behavioral finance

0 notes